This plan will cost around $36 million dollars. Because MISD Board and district leadership have been careful stewards of both taxpayer and state revenue streams, the district can address needs at Marion High School, Francis Marion Intermediate, Thomas Park and for district elementary students without raising taxes.

To fund this plan, the school board has identified two primary funding sources: a general obligation bond and the Secure an Advanced Vision for Education (also known as SAVE/one-percent sales tax) fund.

The bond, which will not exceed $31 million, must be approved by voters. It will not increase property taxes.

The remainder of the project will be funded by SAVE, which has already been approved by Marion voters. This will also not impact voter’s property taxes.

In addition to these two sources, the district will also be able to put insurance money toward the new activities complex as part of the derecho-damage settlement.

The district will maintain the current tax rate regardless of the outcome of the vote.

If the bond referendum does not pass it would not lower tax rates. The facility needs would remain, and the district would continue to plan for addressing them in the future to include continuing to pay down existing debt through a prepayment levy.

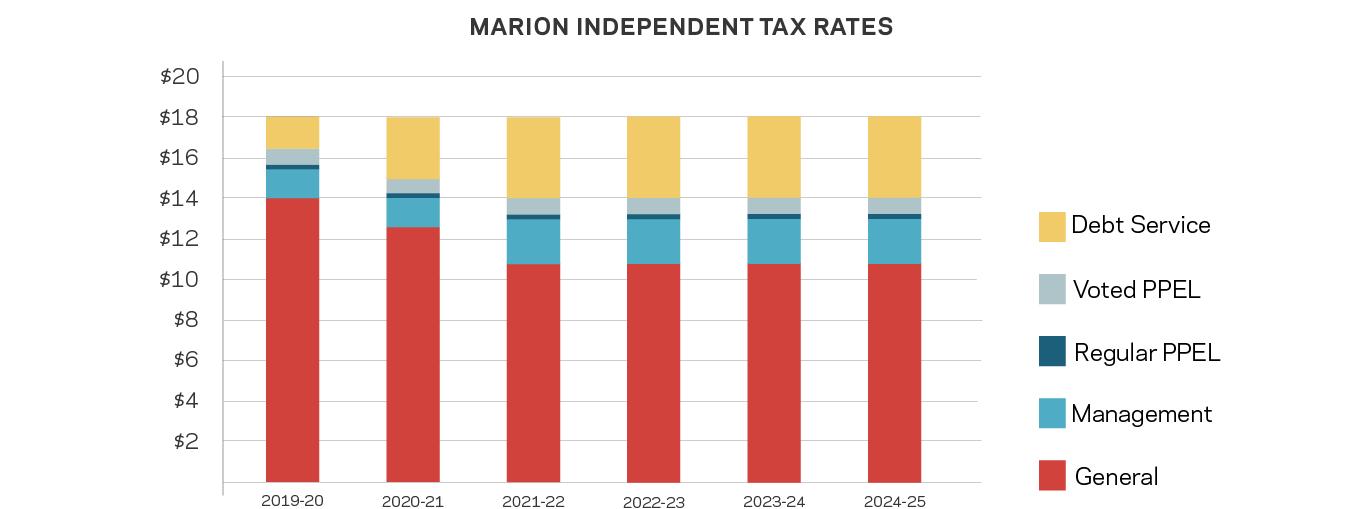

How can we maintain our current tax rate and still pay for the projects?

We can do this because MISD district leadership and Board have strategically been planning for these projects. Our property tax levy is currently made up of four different “buckets:” the general fund, debt service fund, management fund, and PPEL fund. Some of these buckets are projected to decrease, which will allow for general obligation bonds to be sold without an overall increase in taxes.